Understanding Your Financial Aid Package

To help you better understand how financial aid works, we’ve excerpted a sample letter below and provided additional detail and explanation. If you have any questions after reading this, please let us know. You’ll find our contact information at the end.

Key things to remember about cost of attendance:

- Costs are based on a full year (not per term).

- Living expenses are estimates.

- The out-of-pocket cost is different for each student based on need, merit and other criteria.

Need a refresher on financial aid terminology?

Cost of Attendance

Begin snippet of example letter: Cost of Attendance section

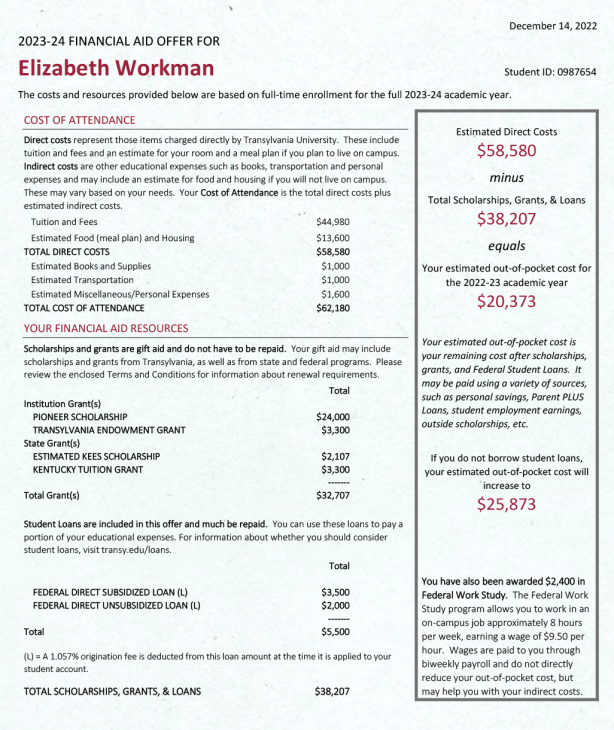

Direct costs represent those items charged directly by Transylvania University. These include tuition and fees and an estimate for your room and a meal plan if you plan to live on campus. Indirect costs are other educational expenses such as books, transportation and personal expenses and may include an estimate for food and housing if you will not live on campus. These may vary based on your needs. Your Cost of Attendance is the total direct costs plus estimated indirect costs.

Tuition and Fees $44,980

Estimated Room and Board (Meal Plan) $13,600

TOTAL DIRECT COSTS $58,580

Estimated Books and Supplies $1,000

Estimated Transportation $1,000

Estimated Miscellaneous/Personal Expenses $1,600

TOTAL COST OF ATTENDANCE $62,180

End snippet of example letter

Remember:

- These are the costs before scholarships, grants, loans and work study have been applied.

- Room and board and additional expenses (books, supplies, transportation and personal expenses) are estimates. The final cost will depend on the plans you choose; some cost more, some less.

- Even before we apply financial aid, Transy costs around $10,000 less than the average top-100 liberal arts college. And because our average 4-year graduation rate is higher than many other colleges, you’ll end up spending less on college and begin earning in the workforce sooner.

Your Financial Aid Resources

Begin snippet of example letter: Your Financial Aid Resources section

Scholarships and grants are gift aid and do not have to be repaid. Your gift aid may include scholarships and grants from Transylvania, as well as from state and federal programs. Please review the enclosed Terms and Conditions for information about renewal requirements.

Institution Grant(s)

Pioneer Scholarship $24,000

Transylvania Endowment Grant $3,300

State Grant(s)

Estimated Kees Scholarship $2,107

Kentucky Tuition Grant $3,300

Total Grant(s) $32,707

Student Loans are included in this offer and much be repaid. You can use these loans to pay a portion of your educational expenses. For information about whether you should consider student loans, visit transy.edu/loans.

Federal Direct Subsidzed Loan (L) $3,500

Federal Direct Unsubsidized Loan (L) $2,000

Total Loan(s) $5,500

(L) = A 1.057% origination fee is deducted from this loan amount at the time it is applied to your student account.

Total Scholarships, Grants, & Loans $38,207

End snippet of example letter

- Scholarships and grants included in your financial aid resources do not need to be paid back. However, you need to know that scholarships and grants are limited to four years of college — another reason Transy’s excellent 4-year graduation rate is such a big help. Your admission letter specifies the grade point average you must maintain for renewal of your scholarship in subsequent years. You should also keep in mind that some grants require you to complete a FAFSA each year you’re enrolled in college.

- Contact the Office of Financial Aid if you have received any additional outside scholarships. They’ll work with you to add your outside scholarship to your financial aid package.

- If you file a FAFSA, we will include federal student loans in your offer. Accepting these loans is optional, and not everyone qualifies to receive them.

- There are two types of federal student loans:

- A subsidized loan is based on financial need. The federal government pays the interest while you’re enrolled in school. You don’t have to pay it back until after you complete your education or leave school.

- An unsubsidized loan is not need-based. You will be charged interest from the time the loan is made until it is paid in full. You don’t need to repay this loan until after you graduate or leave school.

- Our student loan default rate is lower than the average private or public college, which demonstrates Transy students are overwhelmingly willing and able to repay their student loan obligations.

Remember: If you file a FAFSA and are eligible for work study, you will have this section on your offer letter. Work study earnings are not immediately applied to college payments. Earnings are paid directly to you, and you can choose to apply them to your student account or use them as needed for books, living expenses, etc.

Estimated Cost

Begin snippet of example letter: Estimated Costs section

Estimated Direct Costs

$58,580

minus

Total Scholarships, Grants, & Loans

$38,207

equals

Your estimated out-of-pocket cost for the 2021-22 academic year

$20,373

Your estimated out-of-pocket cost is your remaining cost after scholarships, grants, and Federal Student Loans. It may be paid using a variety of sources, such as personal savings, Parent PLUS Loans, student employment earnings, outside scholarships, etc.

If you do not borrow student loans, your estimated out-of-pocket cost will increase to

$25,873

You have also been awarded $2,400 in Federal Work Study. The Federal Work Study program allows you to work in an on-campus job approximately 8 hours per week, earning a wage of $9.50 per hour. Wages are paid to you through biweekly payroll and do not directly reduce your out-of-pocket cost, but may help you with your indirect costs.

End snippet of example letter

Your estimated out-of-pocket cost for the 2023-24 academic year is highlighted. It takes the initial estimated Total Direct Cost from the Cost of Attendance section and subtracts the grants, scholarships and loans in your offer.

In this example, it would be:

$58,580 Total Direct Costs

−$38,207 Total scholarships grants and loans

20,373 The out-of-pocket cost for 2023-24

Additional Education Resources

Begin snippet of example letter: Additional Education Resources section

12-Month Payment Plan: Transylvania University offers a 12-month payment plan that allows you to divide your remaining net direct costs into 12 monthly payments. Your estimated monthly payment under this plan is $1,698.

Additional Borrowing: Subject to credit approval, your parent may be able to borrow up to $21,573 through the Federal Parent PLUS Loan program. If you are interested in this program, please contact the Office of Financial Aid for additional information about how to apply. We recommend borrowing as little as possible and only what you need.

Level Tuition Option: Transylvania’s level tuition program allows you to lock in a set tuition rate for four consecutive academic years. This plan is available to you as a new, full-time, first-year student. If you choose this option, you will pay slightly more than the standard tuition for the first year, but will be guaranteed the same tuition rate for the following three academic years. The level tuition program is optional and covers tuition for each fall and winter term up to the maximum full-time course load. You will receive an e-mail from the Office of Admissions with more information in the coming weeks.

End snippet of example letter

You may be able to lock in your tuition rate for four years (and save money), pay for your education in smaller monthly payments (12-month payment plan) and/or explore additional loans that may be available through the parent or private loan programs.

By the Numbers

Begin snippet of example letter: By the Numbers section

If you do not select the Level Tuition Option

Total Direct Costs $58,580

minus Your Scholarships and Grants – 31,819

equals Your Net Direct Cost after Gift Aid = 24,601

minus Your Student Loan Eligibility – 5,500

equals Your estimated Out-of-Pocket Cost = $20,373

If you select the Level Tuition Option

Total Direct Costs $58,580

minus Your Scholarships and Grants – 32,707

equals Your Net Direct Cost after Gift Aid = 25,873

minus Your Student Loan Eligibility – 5,500

plus the Level Tuition Premium + 1,500

equals Your estimated Out-of-Pocket Cost* = $21,873

* Selecting Level Tuition will also increase your estimated monthly payment on the 12-month payment plan by $125 each month.

End snippet of example letter

Tuition rates are known to go up each year as college expenses increase. We offer you the choice of a payment plan that “locks in” the current rate and saves you money in the long run. (The grid shows you how it works.) You pay a little more during your first two years, but the savings begin during your junior and senior years.

Estimated savings for Class of 2027 on level tuition program*

| Year | Base Tuition | LTP Tuition | Savings |

|---|---|---|---|

| 2023-24 | $43,160 | $44,660 | $(1,500) |

| 2024-25 | $44,500 | $44,660 | $(160) |

| 2025-26 | $45,800 | $44,660 | $1,140 |

| 2025-27 | $47,200 | $44,660 | $2,540 |

| TOTAL | $180,660 | $178,640 | $2,020 |

* = assumes 3% tuition increase per year

Next Steps

Begin snippet of example letter: Next Steps

We’re very excited to welcome you to the Pioneer family! If you’re ready to make Transylvania your college home, be sure to submit your $350 enrollment deposit at transy.edu/deposit.

Watch your Transylvania email inbox over the summer for more information about next steps for your work-study and student loan options. We will reach out to you with the items you need to complete in order to take advantage of these.

If you have questions about your financial aid offer or any of the options or details in it, please contact us at financialaid@transy.edu or 859-233-8239. We would be happy to talk with you via email, over the telephone or by virtual appointment—just let us know what works best for you!

End snippet of example letter

Review Your Action Steps

If you’re ready to take the next step, here’s what you need to do:

- Become a Pioneer! Submit your $350 nonrefundable deposit.

- Consider your financial aid options. If you’ve been offered work-study or student loan options, stay tuned for more information about next steps specific to these programs. We’ll reach out to you via email over the summer to explain the additional steps you’ll need to take if you want to take advantage of these options.

- Sign up for admitted student events. We are hosting a variety of events this year to help make your final college decision. You can ask questions with admissions staff, talk to professors, meet other students and learn all about what makes life at Transy so amazing. Check out our visit options, which are updated throughout the year, and keep your eye out for events that interest you!

- Keep your counselor up-to-date! Keep an eye on your email for our updates. And be sure to let us know if any changes occur to your financial status (whether it’s a gain through additional scholarships received or a loss of funding due to special circumstances). Let us know if you have any questions.

For questions, Contact the Office of Financial Aid

Phone: 859-233-8239 or 800-872-6798

Fax: 859-281-3650

FinancialAid@transy.edu

Old Morrison, 1st Floor

Hours M-F, 8:30 a.m.-5 p.m.

300 North Broadway

Lexington, Kentucky

40508-1797